Rain.Credit : Off-Chain Oracle Analytics Aggregation

With the growth and development of the Crypto or blockchain ecosystem, a number of alternative investment options have emerged, and have proven to be more efficient and profitable investment tools than traditional financial returns. Innovative projects consistently appear in the crypto industry with high return investments and a continuous trend, such as Albetrage is one project that will attract large market investments. Why? because this project aims to create a safe and decentralized working model. Rain.Credit is the project you’ve been waiting for......

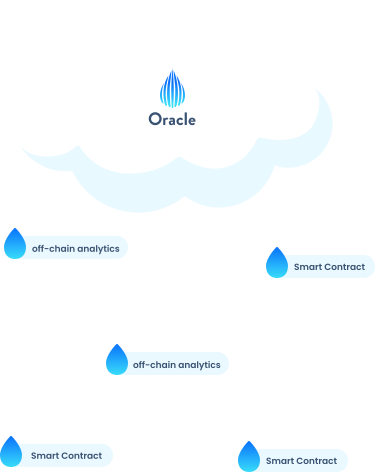

RAIN.CREDIT IS a BEP20 token on the Binance Smart Chain that acts as an Oracle Aggregator non-custodial Off-Chain Data analyzer that assigns a short Credit rating to a user’s address. This credit rating has a function to provide a good collateral factor for all lenders and is also useful for borrowers of digital assets on the rain platform. rain.Credit is based on current decentralized lending platforms and protocols, but with changes to bring more innovative designs and experiences.

what makes us so unique is how we will use Off-Chain Aggregate analysis to help reduce investors’ exposure as they begin to interact with our ecosystem.

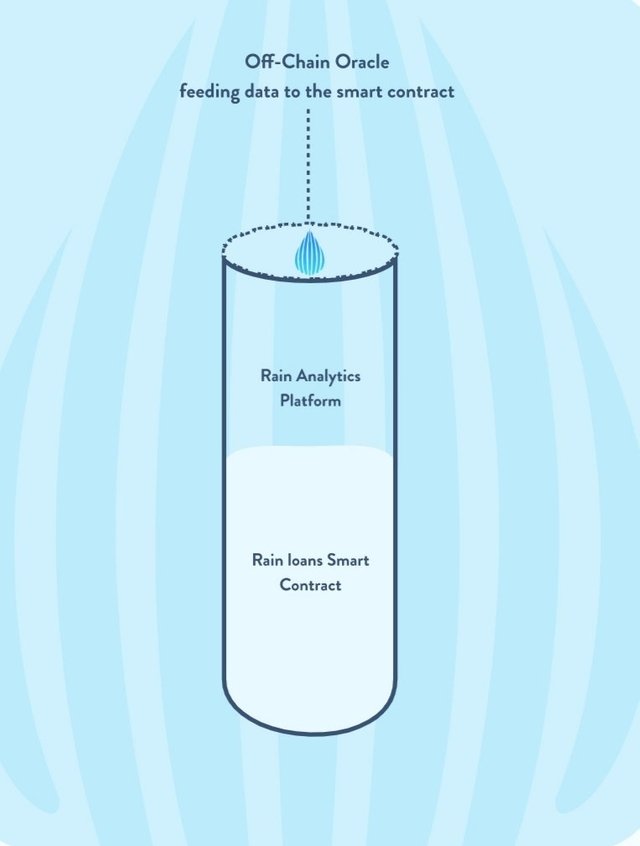

Off-Chain Oracle Analytics Feed On-chain protocols.

Previous migratory flights through DeFi are stored in the history of your Ethereum address. Rain.Credit’s off-chain oracle analytics accesses that history to provide lending platforms with more information about the loan applicant in order to reduce the risk of defaulting.

The more information and history provided by the loan applicant, the less collateral required to borrow, which maximizes the funds available to be accessed.

Some example of real-world events that can affect on-chain loan access and increase the risk of defaulting include, but are not limited to:

Customer account activity

Payment history

New government policies

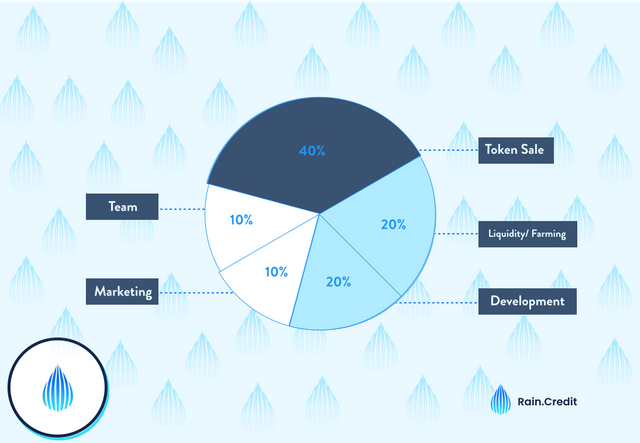

Tokenomics

$RAIN has a simple distribution model. It’s total supply consists of 800,000 $RAIN. The token distribution is as follows:

40% will be sold via presale

20% will be used for project development

20% will be used to provide Liquidity and yield farming

10% tokens will be allocated to the team (For 2 years, these tokens will be locked to instill confidence in the community)

10% will be used for marketin

Borrow More Assets With Less Collateral

Rain Loans is a non-custodial digital asset lending and borrowing platform. It is based on the compound protocol with altered asset pools and the use of Rain+ to increase access to extra funds on top of the current collateralized debt positions (CDP) offered by Compound Finance, AAVE & CREAM.

Rain+ is an additional amount of tokens which we offer to borrowers through our platform without supplying any extra collateral, based on their transaction history and rating from Rain Off-Chain oracle analytics.

For more information, connect to the Rain project. Credits:

Website: https://rain.credit/

Telegram: https://t.me/joinchat/UqEl0GyJZ4WkDUWR

Github: https://github.com/orgs/Rain-Credit

Medium: https://rain-credit.medium.com/

Twitter: https://twitter.com/rain_credit

Discord: https://discord.gg/aEc7NWbU

AUTHOR:

Bitcointalk Unsername: KenzoKen

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2961513;sa=summary

Komentar

Posting Komentar